Commercial real estate is in a state of flux as increasingly advanced technology keeps transforming the property investment landscape. Artificial Intelligence stands at the forefront, changing how things were done from performing real estate investment analysis to making smarter investment decisions.

By using AI and real estate investing hand-in-hand, CRE companies can amplify the true power of real estate investment. AI can transform traditional commercial real estate analysis and investment methods by leveraging advanced algorithms, predictive analytics, and automation and bringing about unprecedented efficiencies, accuracy, and predictive capabilities.

Using cutting-edge AI and machine learning in real estate investment, we aim to uncover the potential for enhanced decision-making, risk management, and optimizing investment strategies in the real estate industry.

Understanding Real Estate Investment Analysis

Real estate investment analysis systematically evaluates property viability, profitability, and risks to inform decisions about buying, selling, or holding assets:

✔️ Assessing Viability: Property analysis helps CRE investors in pinpointing real estate opportunities that can generate high income and appreciate in value. This increases the possibility of securing a more profitable investment.

✔️ Minimizing Risks: Afraid of market crashes? Don’t be. Thorough analysis of diverse factors like market trends and property conditions can reduce the possibility of risks associated with CRE investments. This can protect your capital and facilitate consistent returns over the long term.

✔️ Optimizing Returns: With CRE investment analysis, investors can strategize effectively, determining the most beneficial approaches to maximize returns. This include pinpointing the right property, devising exit strategies, and exploring suitable financial options.

✔️ Strategic Decision-Making: Property investment analysis equips CRE investors with insights into invaluable data, empowering them to make smart decisions regarding commercial investments, including resource allocation, portfolio diversification, and timing in real estate. This reduces the risk of making costly errors and ensures every decision aligns with your financial goal.

Traditional Methods And Challenges Faced In Analyzing Real Estate Investments

Traditional methods of investment analysis for real estate decisions typically involve several challenges:

- Manual data analysis: Historically, commercial real estate investment analysis was time-consuming and error-prone, involving manually collecting and processing data from various sources.

- Subjectivity and bias: Human judgments and biases influence decision-making, leading to subjective evaluations rather than objective assessments.

- Limited data usage: Traditional methods relied on a restricted dataset, potentially missing crucial trends or predictive patterns.

- Limited Scalability: CRE investment companies had difficulty in scaling analysis across a diverse portfolio due to resource-intensive manual efforts and varying property types.

- Risk Assessment: CRE investment firms had a hard time identifying and quantifying risks like market volatility or tenant turnover relied on historical trends, often failing to predict future uncertainties.

- Complex valuation methods: CREs used methods like comparable sales or income capitalization that required extensive computations, risking inaccuracies.

- Time-Intensive Analysis: Manual calculations and evaluations were time-consuming, delaying decision-making processes and potentially missing lucrative opportunities

- Risk evaluation challenges: Comprehensive risk assessment faced difficulties in incorporating market volatility and changing regulations effectively.

- Market dynamics and timeliness: Traditional methods struggled to keep pace with dynamic market changes, affecting timely analysis and decision-making.

- Financial Modeling Challenges: Traditional modeling methods often lacked sophistication in predicting cash flows, ROI, or asset performance accurately.

Addressing these challenges often required significant expertise, time, and resources, which limited the efficiency and accuracy of traditional commercial real estate investment and analysis methods. As a result, there was a growing need for more advanced and efficient approaches.

Technology has increasingly filled this gap, particularly Artificial Intelligence (AI) and machine learning, which offer advanced analytics, predictive modelling, and automation capabilities that optimize and enhance the commercial real estate investment analysis process. AI and ML in real estate investment can handle vast datasets, offer predictive insights, and improve decision-making by minimizing human biases and providing more accurate, timely, and data-driven evaluations.

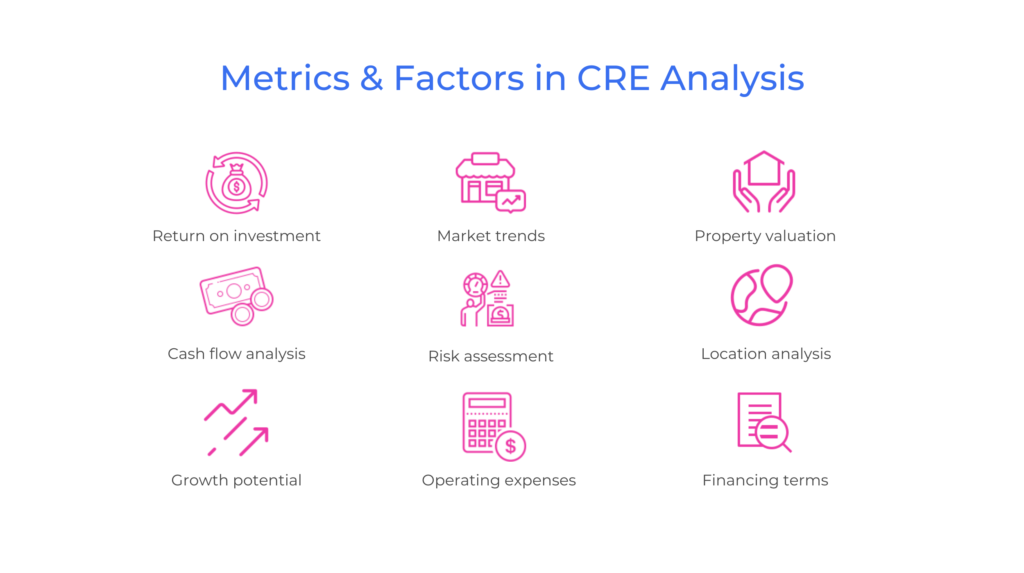

Key Metrics and Factors Considered in Real Estate Analysis

Key metrics and factors pivotal in real estate investment analysis include:

● Return on investment (ROI): Measures potential profitability by comparing net profit to initial investment.

● Market trends: Understanding supply/demand, vacancy rates, and economic indicators for predictive insights.

● Property valuation: Utilizes income, market comparison, or replacement cost approaches.

● Cash flow analysis: Evaluates income against expenses, including debt service and taxes.

● Risk assessment: Considers market, location, regulatory, and unforeseen risks.

● Location analysis: Considers proximity to amenities, transportation, and development plans.

● Growth potential: Assesses future appreciation and economic growth prospects.

● Operating expenses: Estimates maintenance, taxes, insurance, and utility costs.

● Financing terms: Considers interest rates, loan duration, and down payment impact.

These factors collectively guide informed investment decisions, aiding in risk mitigation and optimizing returns in the ever-changing real estate market.

Role of AI in Real Estate Investment Analysis

AI and machine learning in real estate investment involve the use of algorithms and data analysis for process automation, in-depth data scrutiny, and deriving insights necessary for informed decision-making. For C-suite executives in small to medium-sized CRE firms, integrating AI offers a diverse range of benefits that can propel your company forward in this dynamic industry:

1. Personalized Marketing Strategies based on Data Insights

AI’s capabilites in data analytics allows for a granular understanding of market trends and tenant demographics. By using this information, CRE investment firms can design highly targeted marketing campaigns, maximizing the effectiveness of their marketing efforts. Understanding tenant preferences and market demands can help you in crafting compelling leasing strategies that resonate with potential tenants, driving higher conversion rates.

2. Automated Valuation Models (AVM)

AI-powered AVMs streamline and enhance property valuation processes by considering numerous data points, resulting in more accurate and efficient property valuations. This technology aids in better decision-making regarding property acquisitions, sales, and refinancing by providing more precise property values.

3. Market Forecasting

AI’s data analysis enables precise market trend forecasts, helping CRE firms make strategic investment decisions and uncovering emerging markets. Leveraging vast datasets including market dynamics, consumer behavior, and economic indicators, AI anticipates demand shifts and guides agile strategies. This predictive insight facilitates proactive adjustments to seize growth opportunities. AI’s adaptability identifies niche markets and optimizes portfolio diversification. This data-driven approach fosters smarter decision-making, positioning companies strategically in the evolving commercial real estate landscapes.

4. Portfolio Management and Investment Strategy

AI revolutionizes portfolio management by leveraging data analysis to identify lucrative investment prospects, fostering diversification. Its risk assessment algorithms evaluate property and market risks, refining investment strategies for optimized returns. This data-driven approach enhances decision-making and ensures agile adjustments to market dynamics, maximizing portfolio performance.

AI’s insights help CRE firms identify untapped opportunities, align investments with evolving market trends, and reduce risks. This technology empowers commercial real estate firms to make informed, strategic investment decisions that yield higher returns and strengthen their portfolios.

5. Automating Repetitive Tasks

AI’s automation capabilities extend to tasks like lease abstraction, where AI-powered systems extract critical information from lease agreements, ensuring accuracy and efficiency. Financial reporting, another time-consuming task, can be automated with AI, providing real-time insights into the financial health of your properties and portfolio. This automation saves time and ensures accuracy and consistency in data management and reporting.

6. Optimizing Property Operations

AI’s predictive analytics can go beyond just anticipating maintenance needs. It can also optimize energy consumption by analyzing patterns in usage, reducing costs and enhancing sustainability. Identifying operational inefficiencies becomes more precise through AI-driven data analysis, leading to streamlined operations and improved performance across properties in your portfolio. Additionally, AI can facilitate predictive modeling for market trends, allowing for strategic decision-making regarding property acquisitions or divestitures.

7. Predictive Maintenance for Assets

By analyzing historical and real-time data, AI can predict equipment failures, schedule maintenance at optimal times, and even recommend upgrades or replacements. This ensures the assets within your portfolio remain in top condition, reducing downtime, and preserving asset value.

8. Tenant Relationship Management

AI-driven tenant analytics offer deep insights into tenant preferences and behavior. By leveraging this data, you can personalize tenant experiences, offer tailored services, and create custom leasing solutions. This proactive approach not only increases tenant satisfaction and retention rates but also attracts new tenants through improved service offerings.

Benefits of Using AI for Real Estate Investing

Using AI-driven tools and technologies in CRE investment analysis offers several distinct advantages:

✔️ Improved Property Valuation: AI-driven Automated Valuation Models (AVMs) provide faster and more accurate property valuations, aiding in more precise assessments and informed investment decisions.

✔️ Predictive Analytics for Market Trends: AI’s predictive capabilities analyze market trends, enabling proactive strategies to capitalize on evolving market dynamics and maximizing investment returns.

✔️ Automation of Routine Tasks: AI automates repetitive tasks such as paperwork processing, lease management, and financial reporting, freeing up time for strategic decision-making and higher-value activities.

✔️ Enhanced Client Experiences: AI-driven insights into tenant behavior and preferences enable personalized experiences, improving client satisfaction, retention, and overall tenant relationship management.

✔️ Operational Efficiency: AI streamlines property operations by providing predictive maintenance, optimizing energy consumption, and identifying operational inefficiencies, ultimately reducing costs and enhancing property performance.

✔️ Risk Mitigation and Decision-making: AI assesses risks extensively, aiding in proactive risk management and guiding informed investment decisions for optimized portfolio performance.

✔️ Sustainability Initiatives: AI optimizes energy usage, aligning properties with green building initiatives, attracting environmentally conscious tenants, and meeting investor ESG criteria.

✔️ Market Transparency and Comparison: AI-driven insights enable data-driven investment analysis for real estate decisions, aligning investment strategies with market conditions.

Real-Life Examples

Commercial real estate companies use AI to predict property prices, identify optimal investment locations, and streamline property management. For instance, Coldwell Banker uses the CBx Technology Suite to pinpoint properties that are most likely to sell — even before the owner has shown interest. It also offers predictive analytics on where each property buyer is coming from and how to reach them, and based on them, it helps create effective marketing plans.

In addition, CBRE has leveraged AI and ML to create a 25% decrease in manual lease processing time and a whopping 65% decrease in false alarms in managed commercial facilities.

Challenges and Limitations of AI in Real Estate Analysis

Like all technology, AI for real estate investing comes with its share of challenges:

- Data quality & privacy concerns: AI’s accuracy hinges on quality data. Incomplete or biased data can lead to inaccuracies, while privacy compliance poses challenges.

- Initial costs: Implementing AI demands significant upfront investments in technology, infrastructure, and skilled personnel, potentially hindering adoption.

- Dependency on historical data: AI relies heavily on past data for predictions, limiting accuracy in volatile markets with unforeseen events.

- Market unpredictability: The unpredictability of real estate markets poses challenges; AI may struggle to adapt to sudden shifts or unforeseen circumstances.

AI-Powered Tools and Technologies for Real Estate Analysis

AI in real estate investment is revolutionizing the industry, offering a range of sophisticated solutions:

1. Machine Learning Algorithms for Predictive Property Valuation

AI employs machine learning algorithms to predict property values. These algorithms analyze historical sales data, property features, and market trends to determine accurate valuations.

Predicting Property Sales: Achievion created an AI/ML solution for a client looking to forecast property owner’s intention to sell within specific geographic markets, aiming to generate leads for agents. This engine provided the company with a competitive edge, generating cost-effective, high-quality leads for them.

2. Natural Language Processing (NLP) for Sentiment Analysis and Market Trend Predictions

NLP enables the analysis of unstructured data from various sources like social media, news articles, and customer reviews. It interprets sentiments and predicts market trends.

Sentiment Analysis: NLP algorithms interpret text sentiments, helping gauge public opinions about specific areas or properties. This aids in understanding market perception and potential shifts.

3. Data Visualization Tools for Better Insights and Decision-Making

AI-driven data visualization tools transform complex data into easily understandable visual representations, facilitating informed decision-making:

Dashboard Analytics: Tools like Tableau or Power BI create interactive dashboards that display property trends, market data, and investment performance, enabling stakeholders to visualize and understand complex data effortlessly.

These AI-powered tools offer sophisticated functionalities that enable more accurate valuations, predictive insights, and enhanced data visualization capabilities. This empowers property investors to make informed investment decisions in a fast-moving and ever-changing market environment.

How to Implement AI in Real Estate Investment Analysis

Implementing AI in real estate investment analysis involves several key steps and considerations:

Step#1: Assess needs and objectives

Identify areas where AI can add value, such as property valuation, market trend analysis, or risk assessment.

Step#2: Select suitable AI tools

Choose AI-driven platforms or tools that align with your objectives. Consider factors like scalability, data integration capabilities, and compatibility with existing systems.

Step#3: Data collection and preparation

Gather high-quality data from diverse sources. Ensure data cleanliness, accuracy, and relevance; quality data is fundamental for AI analysis.

Step#4: Model development and testing

Collaborate with data scientists or AI experts to develop machine learning models tailored to real estate needs. Test these models rigorously to ensure accuracy and reliability.

Step#5: Implementation and integration

Integrate AI tools into existing workflows and systems. Train personnel on using these tools effectively.

Step#6: Continuous monitoring and improvement

Regularly monitor AI performance and refine models based on feedback and new data to enhance accuracy and relevance.

Step#7: Training and educating stakeholders on AI-driven methodologies

Offer training sessions, workshops, or resources to familiarize stakeholders with AI tools, their benefits, and how to leverage them for investment analysis effectively.

Note: Quality data is essential for effective AI analysis. Clean, diverse, and accurate data ensures the reliability of AI models. It enables accurate predictions, reduces bias, and enhances the overall effectiveness of AI-driven decision-making.

Case Studies or Examples Showcasing Successful AI Implementation

3D Rendering Module by Achievion

A Canadian real estate agency sought to develop a mobile application capable of generating 3D models of houses or apartment rooms using only a smartphone camera. To achieve this, Achievion’s AI team crafted an advanced 3D-rendering module employing Computer Vision technologies like line detection, homography matrix, and the Canny method for edge detection. Simultaneously, the Mobile Development team created an intuitive iOS app seamlessly integrated with the 3D module. Users could capture 2-3 pictures of space from various angles, allowing the app to produce highly accurate 3D models.

The implementation of this innovative mobile app dramatically enhanced the efficiency of the home rental marketing process for the client. Moreover, it opened up a new revenue stream as the company began selling subscriptions to other real estate firms across Canada, capitalizing on the app’s capabilities.

Commercial Real Estate Investment Company Case Study: Predictive Investment Analysis

CRE investment agency aimed to enhance its investment decisions through advanced technology. Achievion was able to develop an AI-driven platform leveraging diverse data sources like CoStar, Trepp, and ATTOM. This platform utilized machine learning models to scrutinize information on Best Strategies, Market Trends, and Geographical Data (population, employment, crime). The outcome was impressive: a comprehensive tool offering detailed insights into potential investment locations. It provided historical data, risk analysis, and real-time property forecasts. This empowered users to confidently explore various markets, compare properties, and make well-informed investment decisions, ensuring they capitalized on lucrative opportunities in the real estate sector.

Future Trajectory of AI in Real Estate Investment Analysis

The future of AI in real estate investment analysis appears promising, poised for further advancements and transformative innovations. AI’s trajectory in the CRE sector is likely to witness:

Increased Adoption: AI tools are increasingly integrated across real estate, enhancing decision-making and optimizing investments.

Refined Predictive Analytics: Advancements in AI algorithms enable more accurate forecasts of market trends, property values, and risk assessments.

Enhanced Personalization: AI facilitates tailored investment strategies aligned with individual preferences and market conditions.

Anticipated advancements and innovations in AI technology for commercial real estate include:

- Further refinement in AI algorithms for analyzing diverse and unstructured datasets, offering deeper insights and predictive capabilities.

- Increased automation of routine tasks in property management, valuation, and customer service, improving efficiency and freeing up resources.

- AI-driven AR/VR applications enable immersive property tours, enhancing buyer experiences and decision-making processes.

Stakeholders are urged to adopt AI tools for two main reasons. Firstly, AI empowers data-driven decision-making, mitigating risks and enhancing profitability through in-depth analysis and predictive capabilities. Secondly, AI provides a competitive edge by enabling swift adaptation to market shifts, fostering a deeper understanding of investment prospects, and capitalizing on opportunities effectively.

How Achievion Can Help

For commercial real estate investors seeking improved real estate investment analysis, explore Achievion’s AI-driven tools and methodologies. We can help you embrace innovation by integrating AI solutions into investment analysis processes, tapping into opportunities for better decision-making and success in the real estate landscape.

By taking AI and real estate investing hand-in-hand, you can transform your commercial real estate investment analysis, empowering C-suite executives with unparalleled insights and capabilities for making informed, strategic decisions in the ever-changing real estate market.

![How to Use ChatGPT for Real Estate [2024 Guide]](https://achievion.com/wp-content/uploads/2024/03/How-to-Use-ChatGPT-for-Real-Estate-2-1024x573.png)